Happy (almost) new year! This year, I’m grateful you chose to subscribe to this newsletter. My #1 goal is to give you an effective B2B ad template every week.

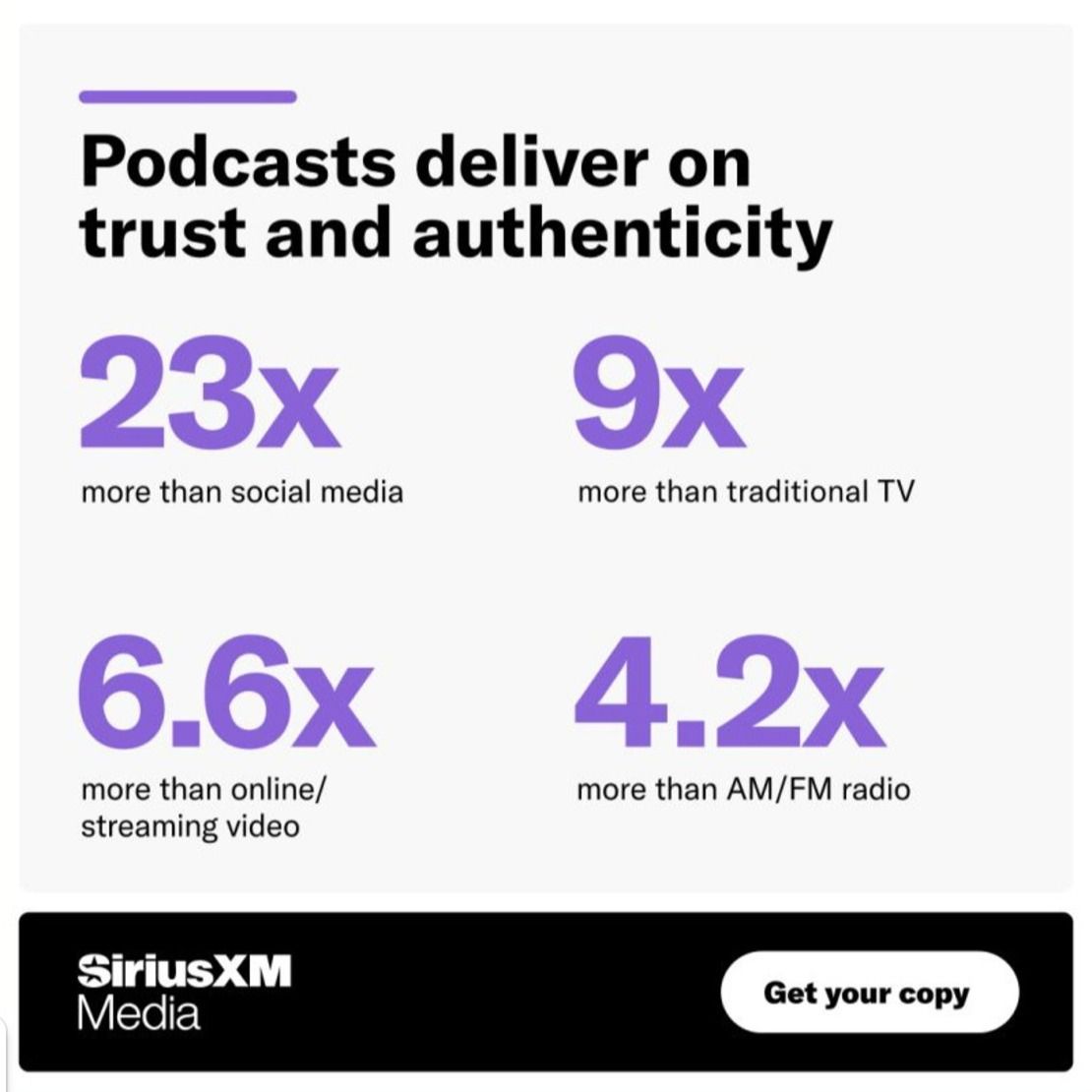

This week’s template is a gem from SiriusXM Media. 4 stats in one creative, paired with a clean design. Each stat highlights the trust and authenticity only podcast ads can offer.

What 4 stats do you have for your product or business that prove your value prop(s)? Add them into this template, update the headline to describe your value prop(s), add a new CTA to match your offer, and put your logo in. Now you’re cooking with a creative that’s worth testing.

Do you have any feedback on this newsletter or the templates? If so, hit reply, and your note will go directly to me. I’d love to hear from you! Good feedback, constructive feedback, even bad feedback.

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd